BACKGROUND

-

The ASEAN-China Framework Agreement on Comprehensive Economic Cooperation was signed at the 6th ASEAN-China Summit in November 2002 and the full establishment of ASEAN-China FTA in January 2010 has provided a strong foundation for the enhancement of ASEAN-China economic relations.

-

The Framework Agreement comprises among others the provisions to establish ACFTA within 10 years: Trade in Goods, Early Harvest Programme, Trade in Services, Investment, Dispute Settlement Mechanism and Economic Co-operation.

-

The ACFTA, implemented on 1 January 2010, provided the required platform for deepening economic engagement. The economic relations became more intense after the signing of the Framework Agreement and subsequently the ASEAN-China Free Trade Agreement in 2004 which provide a sound basis for increasing trade and investments flows between ASEAN and China.

-

In line with the current regional and global economic landscape, the Protocol to Amend the Framework Agreement on Comprehensive Economic Co-Operation between ASEAN and China was signed on 22 November 2015 at the 27th ASEAN Summit. The upgrading of the ACFTA aims to further streamline and enhance economic cooperation, including amendments to the agreement on Trade in Goods, Services, Investment and Economic and Technical Cooperation (ECOTECH).

TRADE IN GOODS

-

The TIG Agreement, signed on 29 November 2004, is one of the enabling agreements under the Framework Agreement. It laid down the modality for tariff reduction and elimination for tariff lines either the Normal Track or the Sensitive Track.

-

The program for import duty reduction and elimination under the ACFTA began in July 2005. Since then, duties have been progressively reduced or eliminated. Prior to the implementation of the ACFTA, ASEAN and China also undertook to eliminate import duties for agricultural and selected manufactured products under the Early Harvest Programme (EHP) from 2004-2006. As such, the duties on most products have already been eliminated.

-

TIG Agreement also provides for the subsequent liberalization of products in Sensitive Track and the elimination of non-tariff barriers. Beginning 2012, ASEAN-6 (Brunei Darussalam, Indonesia, Malaysia, the Philippines, Singapore and Thailand) and China have commenced tariff reduction on products in the Sensitive List. ASEAN-6 and China shall reduce the tariff rates placed on Sensitive Lists (SL) to 20% on 1 January 2012 and to 0-5% by 2018. For Highly Sensitive List (HSL), duties will be reduced to 50% in 2015 with no further tariff reduction commitments thereof.

-

Please click the following link to view the tariff reduction schedules under ACFTA:

RULES OF ORIGIN

-

In order to enjoy the preferential tariff concession under the ACFTA, the products exported by ASEAN or China must comply with the Rules of Origin (ROO). The two most important requirements under the ROO are the origin criteria and the Operational Certification of Procedures (OCP) for issuance and verification of the Certificate of Origin, Form E.

-

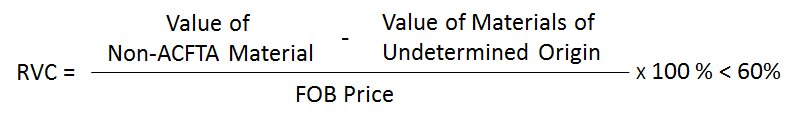

According to Article 5 of the Trade in Goods Agreement, the current origin criteria imposed under the ACFTA is General ROO 40% Regional Value Content (RVC) and limited application of Product Specific Rules (PSR). The formula for the 40% ACFTA content is calculated as follows:

The ACFTA content = 100% - Non-ACFTA Materials = at least 40%

-

Apart from the General ROO, ASEAN and China have also adopted Product Specific Rules (PSR) for the following products:

-

textiles and apparel;

-

plastic products;

-

footwear products;

-

iron and steel products;

-

preserved fish and canned products;

-

palm oil and ice cream; and

-

jewelry products.

-

-

ASEAN and Chinese exporters/manufacturers now have the flexibility of choosing the most convenient rule in meeting the origin criteria of the products i.e., either 40% Regional Value Content (RVC) or PSR.

-

To obtain the Certificate of Origin Form E, exporters are also required to fulfill the conditions for the issuance and verification of the Form E. Further improvement on Operational Certificate Procedures (OCP) was carried out to simplify the rules and trading procedures under the ACFTA.

-

Please click the following link to view the revised OCP:

TRADE IN SERVICES

-

In addition to Trade in Goods Agreement, ASEAN and China also signed Trade in Services Agreement (ACTISA) on 14 January 2007 for the 1st package specific commitments and on 16 November 2011 for the 2nd package of specific commitments. Both packages provide for the expansion of trade in services with improved market access and national treatment in sectors/subsectors where commitments have been made. The Agreement excludes services liberalization pertaining to government procurement and government related services.

-

Malaysia's liberalization commitments under the 1st Package include sectors such as:

-

architecture;

-

engineering;

-

telecommunications;

-

financial services;

-

education;

-

health; and

-

tourism.

-

-

China has also liberalised sectors such as:

-

computer and related services,

-

management consulting services,

-

construction,

-

environmental services,

-

recreational services and

-

transport services.

-

-

The Protocol to Amend the ASEAN-China Trade in Services Agreement for the 2nd package of Commitments was signed on 16 November 2011. The entry into force of the Protocol is on 1 January 2012.

-

Malaysia offers 30 new sub-sectors and improvements in 2 sub-sectors. Malaysia’s commitments under this package include improvements in foreign equity ownership ranging from 10% to 100%:

New Sub-Sectors (30)

-

Professional services (6)

-

R&D services (1)

-

Rental Services w/o Operator (1)

-

Other Business Services (9)

-

Audio visual (1)

-

Education Services (1)

-

Tourism (3)

-

Recreational (2)

-

Transport (5)

-

Other Services (1) - vocational training

Improvements (2)

-

Architecture (1)

-

Theme Park (1)

-

-

China offers 47 new sub-sectors and improvements in 10 sub-sectors:

New Sub-Sectors (47)

-

Professional Services (8)

-

Other business Services (12)

-

Courier (1)

-

Telecommunication (1)

-

Audio-Visual (2)

-

Distributive (5)

-

Education (5)

-

Tourism (2)

-

Transport (11)

Improvements (10)

-

Construction and engineering (5)

-

Environmental Services (4)

-

Recreational (1)

-

-

The 3rd Package of Specific Commitments under the ASEAN-China Trade in Services Agreement was incorporated under the Upgrading ACFTA signed on 22 November 2015 comprised improvements in the following areas:

-

Increased foreign equity limitation to 30% from 10% for Multi-Disciplinary Practices (MDP) for engineering and architectural services; and

-

New offer on veterinary services with up to 49% foreign equity.

-

-

Malaysia has retained all the offers that have been outlined in the preceding ACTIS second package with improvements on three sub-sectors, namely:

-

architects (one sub-sector);

-

engineering (1 sub-sector); and

-

Veterinary (1 sub-sector).

-

-

China’s offer applicable to all AMS under the 3rd Package includes improvements in the following areas:

-

Removal of Market Access limitations for Tour Agency and Tourist Guide (CPC 7471);

-

Further flexibilities on performance criteria of foreign companies participation in engineering and construction sectors in China; and

-

Allowing foreign service suppliers to provide the following services to Chinese Qualified Institutional Investors (QDII):

-

trading for account of QDII?

-

providing securities trading advice or portfolio management? and

-

providing custody for overseas assets of QDII.

-

-

INVESTMENT

-

The ASEAN-China Investment Agreement was signed on 15 August 2009 and entered into force on 1 January 2010. It aims to create a favourable environment for the investors and their investments from ASEAN and China, and therefore stipulates key protection elements that will provide fair and equitable treatment to investors, non-discriminatory treatment on nationalisation or expropriation and compensation for losses. It has provisions that allow transfers and repatriation of profits to be made freely and in freely usable currency as well as a provision on investor-state dispute settlement that provides investors recourse to arbitration.

-

The Agreement covers protection elements with a review mechanism to discuss the liberalisation elements at a later date. The review is for the purpose of improving the transparency of investment rules and progressively liberalizing the investment regimes of ASEAN and China.

-

The review in Investment Agreement under the Upgrading ACFTA signed on 22 November 2015 covers Promotion and Facilitation for investment:

-

improved facilitation to doing business (getting license/permit for business operation);

-

utilize existing investment promotional agencies and where possible the establishment of one-stop center;

-

promote activity to enhance Industrial Complementary/Networks; and

-

optimization of existing arrangements for investment promotion and facilitation initiatives.

-

RELATED DOCUMENTS

-

Tariff Reduction Schedules for ACFTA

-

Review on the Operational Certification Procedures (OCP) of ASEAN-China FTA

-

Tariff Reduction Schedules on Sensitive Track under ACFTA

-

Product Specific Rules under the ASEAN-China Free Trade Area

-

-

ACFTA Upgrading Protocol (2019) ANNEX 1 Revised ACFTA Rules of Origin

-

ACFTA Upgrading Protocol (2019) ANNEX 1 Attachment A Revised Operational Certification Procedures

-

ACFTA Upgrading Protocol (2019) ANNEX 1 Attachment A Appendix 1 Revised Certificate of Origin Form E

-

ACFTA Upgrading Protocol (2019) ANNEX 1 Attachment B Product Specific Rules in HS 2017

-

-

ACFTA 3rd Package of Trade in Services (TIS)

CONTACT US

For matters relating to processing of Preferential Certificate of Origin (CO Form E) / Rules of Origin, please contact:

- Mr. Mohamad Naim Othman

DL: 03-62084770

Email: naim.othman@miti.gov.my

- Ms. Nur Afiqah Md Nasir

DL: 03-6208 4718

Email: afiqahnasir@miti.gov.my

For other enquiries on policies matters under ACFTA, please contact the following officers:

- Ms. Siti Hailwa Marjunit (Policies and Tariff Duties)

DL: 03-6200 0398

Email: hailwa@miti.gov.my

- Ms. Farah Lyana Zulkipli

DL: 03-6200 2377

Email: farahlyana@miti.gov.my

|

Ministry of Investment, Trade and Industry

Visitor Count : 1437906

Last updated : 21-01-2026

|

Security Policy | Privacy Policy | Term & Conditions | Disclaimer

Best viewed using Internet Explorer 10 and above with resolution 1280 x 800 |

|

|