BACKGROUND

-

ASEAN and Japan first established informal dialogue relations in 1973, which was later formalised in March 1977 with the convening of the ASEAN-Japan Forum. Since then, significant progress has been made in all areas economic cooperation.

-

Japan’s strong commitment to support ASEAN Community building is evident through its initiatives and support for many concrete and mutually beneficial activities. ASEAN robust economic growth has also contributed to the strengthening of relations with Japan.

-

The Framework for Comprehensive Economic Partnership (CEP) between ASEAN and Japan was signed by the Leaders of ASEAN and Japan on 8 October 2003 in Bali during the ASEAN-Japan Summit. Under this Framework Agreement, all the Parties had committed to a CEP between ASEAN and Japan, to strengthen economic ties, create a larger and more efficient market with greater opportunities and larger economies of scale, and enhance attractiveness to capital and talent, for mutual benefit.

-

Following the signing of the Framework Agreement, negotiations on the ASEAN-Japan CEP (AJCEP) Agreement was commenced in April 2005, and after 11 rounds of negotiations, it was substantially concluded in November 2007.

-

The ASEAN Member States and Japan signed the ASEAN-Japan Comprehensive Economic Partnership (AJCEP) on 14 April 2008. The Agreement entered into force on 1 December 2008. For Malaysia, it entered into force on 1 February 2009.

-

Although the AJCEP is based on the respective bilateral Economic Partnership Agreements (EPAs) signed by Japan with individual ASEAN countries, including Malaysia, there is substantial value-adding to these EPAs under the AJCEP.

Scope

-

ASEAN-Japan Comprehensive Economic Partnership (AJCEP) Agreement is a comprehensive agreement which include Trade in Goods and Trade in Services, Trade in Investment, Rules of Origin (ROO), Sanitary and Phyto-Sanitary (SPS), Technical Barriers to Trade (TBT), Dispute Settlement Mechanism (DSM) and Economic Cooperation.

-

The AJCEP are fully realised by ASEAN-6 (Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand) and Japan in 2015 when tariffs on substantially all products have been eliminated, except for those on the Sensitive Track. To date, Malaysia has eliminated duties for 93.57% of products in the normal track.

-

The negotiations on Trade in Services including the Financial and Telecommunication annexes and Movement of Natural Persons (MNP) Chapters as well as the investment negotiation under the ASEAN-Japan have been concluded. ASEAN and Japan is currently finalising the legal instrument to materialise the Trade in Services including the Annexes on Financial Services and Telecommunications, Movement of Natural Persons (MNP) and Investment Chapters into the AJCEP Agreement. The signing is targeted at the end of 2017.

Benefits

-

Benefits to Malaysia's consumers and business community will be significant as Japan is Malaysia's 4th largest trading partner in 2016.

-

A key benefit is market access through lower tariff concessions and cumulative rules of origin, and hence more competitive prices and greater choice of products for consumers.

-

The two-way trade between ASEAN and Japan reached US$239 billion in 2015, accounting for 10.5 per cent of ASEAN’s total trade. Meanwhile, Foreign Direct Investment (FDI) flows from Japan to ASEAN amounted to US$17.4 billion, accounting for 14.5 per cent of total FDI inflows into ASEAN. Japan is ASEAN’s second largest trading partner and source of FDI for ASEAN.

-

The FTA enables ASEAN and Japan to share the huge resources available through joint collaboration to further promote the growth of both the manufacturing and services industries.

-

The AJCEP Agreement offers traders in Malaysia the advantage of cumulation in meeting ROO. Meaning, Traders can enjoy a larger sourcing base, i.e. they can use raw/intermediate materials from any of the AJCEP parties and enjoy preferential tariffs.

-

For Malaysia, the AJCEP provides additional benefits in terms of immediate and accelerated elimination of duties for products vis-à-vis progressive liberalisation under the bilateral agreement with Japan i.e. Malaysia-Japan Economic Partnership Agreement (MJEPA). Some of the products which were not offered by Japan under MJEPA and had duty liberalised under AJCEP Agreement.

TRADE IN GOODS

-

Under the Trade in Goods, to date, Malaysia has eliminated duties for 93.57 per cent of products in the normal track. For goods under the Highly Sensitive List, Sensitive List and Exclusion List, the modality varies and the tariff cuts were negotiated bilaterally between ASEAN Member States and Japan, taking into account the sensitivities of the parties.

-

Chapter 2 (Trade in Goods) of the AJCEP Agreement provides for trade in goods which covers key elements as follow:

-

Elimination and reduction of customs duties on originating goods of other Parties in accordance with Annex 1 (Schedules for the Elimination or Reduction of Customs Duties) of the Agreement;

-

Elimination of non-tariff measures including quantitative restrictions on the importation of any good of the other Parties or on the exportation or sale for export of any good to other Parties (except permitted under the WTO Agreement);

-

Application of safeguard measures to prevent injuries to domestic industry;

-

Arrangement for modifications of concessions; and

-

Simplification and harmonisation of Customs Procedures as well as information sharing on laws and regulations relating thereto for transparency.

RULES OF ORIGIN

-

Rules of Origin (ROO) for AJCEP are provided for under Chapter 3 of the Agreement. Trade facilitating ROO have been established under the AJCEP that would help encourage regional cumulation of inputs benefitting both ASEAN Member States and Japan.

-

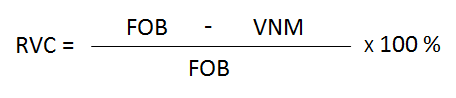

The AJCEPs ROO has a general rule of RVC (Regional Value Content) 40% or CTH (Change in Tariff Heading), thereby providing flexibility for exporters / manufacturers in choosing the rule to apply.

-

To avail tariff preferential under AJCEP, Rules of Origin set out in the Agreement must be complied and Certificate of Origin under AJCEP must be used.

Note :

-

RVC – Regional Value Content

-

FOB – Free-on-board Value

-

VNM – Value of non-originating materials

RELATED DOCUMENTS

-

Annex I - Schedules for the Elimination on Reduction of Custom Duties

-

Brunei

-

Cambodia

-

Indonesia

-

4. Japan

-

5. Lao PDR

-

6. Malaysia

-

7. Myanmar

-

8. Philippines

-

9. Singapore

-

10. Thailand

-

11. Vietnam

-

Annex II - Product Specific Rules

-

Annex III - Information Technology Products

-

Annex IV - Operational Certificate Procedures

-

Annex V - Work Programme for Economic Cooperation

-

Revised ASEAN Version of the CO Form under ASEAN Japan Comprehensive Economic Partnership (CO Form AJ)

(to attach the document CO Form AJ (ASEAN Version)

CONTACT US

For matters relating to Preferential Certificate of Origin (CO Form AJ) / Rules of Origin, please contact:

- Mr. Mohamad Naim Othman

DL: 03-62084770

Email: naim.othman@miti.gov.my

- Ms. Nur Afiqah Md Nasir

DL: 03-6208 4718

Email: afiqahnasir@miti.gov.my

For other enquiries on policies and tariff lines, please contact the following officer:

- Ms. Darshini Subramaniam

DL: 03-62000388

Email: darshini@miti.gov.my

|

Ministry of Investment, Trade and Industry

Visitor Count : 1438896

Last updated : 24-01-2026

|

Security Policy | Privacy Policy | Term & Conditions | Disclaimer

Best viewed using Internet Explorer 10 and above with resolution 1280 x 800 |

|

|