BACKGROUND

-

At the 2nd ASEAN-India Summit in 2003, the Leaders signed the ASEAN-India Framework Agreement on Comprehensive Economic Cooperation.

-

The Framework Agreement laid a sound basis for the establishment of an ASEAN-India Free Trade Area (FTA), which includes FTA in goods, services and investment.

TRADE IN GOODS

-

The signing of the ASEAN-India Trade in Goods Agreement (AITIGA) on 13 August 2009 in Bangkok paves the way for the creation of one of the world’s largest free trade areas with almost 1.8 billion people and a combined Gross Domestic Product (GDP) of US$4.5 trillion.

-

The AITIGA entered into force on 1 January 2010.

-

As detailed in Annex I of the AITIGA the Parties will reduce and/or eliminate their tariffs under a Normal Track (divided into Normal Tracks 1 and 2), Sensitive Track, Special Products and Highly Sensitive List.

RULES OF ORIGIN

-

The Rules of Origin are covered by Article 7 and Annex 2 of the AITIGA.

-

Products imported by a Party which are consigned directly shall be deemed to be originating and eligible for preferential tariff treatment if they conform to the origin requirements under any one of the following:

-

Products which are wholly obtained or produced in the exporting Party; or

-

For products not wholly produced or obtained in the exporting Party, a product shall be deemed to be originating if:

-

the AIFTA content is not less than 35% of the FOB value; and

-

the non-originating materials have undergone at least a change in tariff sub-heading (CTSH) level of the Harmonized System,

-

provided that the final process of the manufacture is performed within the territory of the exporting Party.

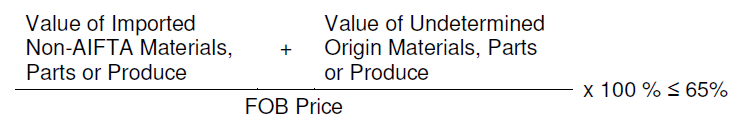

- The formula for the 35% AIFTA content is calculated respectively as follows:

- Direct Method

- Indirect Method

-

The value of the non-originating materials shall be:

-

the CIF value at the time of importation of the materials, parts or produce; or

-

the earliest ascertained price paid for the materials, parts or produce of undetermined origin in the territory of the Party where the working or processing takes place.

-

TRADE IN SERVICES

-

The ASEAN-India Trade in Services Agreement (AITISA) was signed on 13 November 2014 at the sidelines of the 25th ASEAN Summit in Nay Pyi Taw, Myanmar.

-

The AITISA entered into force on 1 July 2015 for six ASEAN Member States, namely Brunei Darussalam, Malaysia, Myanmar, Singapore, Thailand, and Viet Nam, as well as India. The agreement has also entered into force for Lao PDR and Philippines on 15 September 2015 and 6 December 2016, respectively.

-

India has one Schedule of Commitments (SOC) with 8 ASEAN Member States and a separate SOC for Indonesia and the Philippines.

-

The AITISA contains provisions on transparency, domestic regulations, recognition, market access, national treatment and dispute settlement. India’s offers cover professional services, medical and dental, computer related services, communication, construction, financial, healthcare, tourism and transport services.

INVESTMENT

-

The ASEAN-India Investment Agreement (AIIA) was signed on 12 November 2014 in Nay Pyi Taw, Myanmar and entered into force on 1 July 2015 for six ASEAN Member States, namely Brunei Darussalam, Malaysia, Myanmar, Singapore, Thailand, and Viet Nam, as well as India. The agreement has also entered into force for the Philippines on 17 March 2016.

-

The ASEAN-India Investment Agreement stipulates protection of investment to ensure fair and equitable treatment for investors, non-discriminatory treatment in expropriation or nationalisation as well as fair compensation.

RELATED DOCUMENTS

-

Schedule of Tariff Commitments

-

Custom Duties (Goods under Agreement on Comprehensive Economic Cooperation between ASEAN and India) Order 2009

-

Schedule of Specific Commitments

CONTACT US

For matters relating to Preferential Certificate of Origin (CO Form AI) / Rules of Origin, please contact:

- Mr. Ahmad Nadzreen Mohamad Ali

DL: 03-6208 4751

Email: nadzreen.ali@miti.gov.my

- Ms. Lustia Karena Abd Aziz

DL: 03-6208 4747

Email: lustia@miti.gov.my

For other enquiries on policies and tariff duties, please contact the FTA focal point as follows:

- Ms. Wee Nee Angeline

DL: 03-6200 0385

Email: angeline.wee@miti.gov.my

|

Ministry of Investment, Trade and Industry

Visitor Count : 1427890

Last updated : 16-12-2025

|

Security Policy | Privacy Policy | Term & Conditions | Disclaimer

Best viewed using Internet Explorer 10 and above with resolution 1280 x 800 |

|

|